Research Article

Creative Commons, CC-BY

Creative Commons, CC-BY

A Note on Omnichannel in Healthcare Market: An Exploratory Roadmap

*Corresponding author: Theresia Njuabe Metoh, Department of Biochemistry, Faculty of Science, The University of Bamenda, Cameroon.

Received: February 24, 2022; Published: March 04, 2022

DOI: 10.34297/AJBSR.2022.15.002148

Abstract

Purpose: Healthcare consumers increasingly demand for better healthcare experiences and seamless navigation throughout their care journey from registration to discharge and beyond. This paper explores a road map to establish omnichannel framework in healthcare marketing.

Design/methodology/approach: Omnichannel in healthcare has never been explored before. Therefore, we use an exploratory map to build knowledge on how firms manage building roadmap to a successful omnichannel in healthcare market. This approach allows us to gain multi-faceted perspectives that necessary to understand the complexities of omnichannel adoption process.

Findings: While consumers (patients) are ready to engage omnichannel experiences, providers are not ready yet for such new marketing strategies. This study finds that in order to implement omnichannel in healthcare market, multichannel care system has to be in place. Omnichannel in healthcare market may give patients their “voice” in their health management.

Originality: As far as we know, this paper is the first research attempt exploring a roadmap to omnichannel marketing strategies in healthcare field.

Keywords: One-stop-shop, Single channel providers, Multichannel providers, Omnichannel healthcare providers, Digital divide, Healthcare consumerism, Intergenerational training programs, Supply chain operations

Introduction

As out-of-pocket healthcare costs and health payer deductibles have both grown, the patients are increasingly considering themselves as major payers for their care. In the United States, the ongoing growth of cost-sharing has given consumers greater influence over healthcare delivery and cost management. For example, between 2006 and 2015, the average deductible for employees with employer-sponsored insurance grew by more than 120% [1]. Consumers now directly control $330 billion annually in out-of-pocket healthcare expenses worldwide [2] and the choices that they make have the potential to affect 61% of all healthcare spending [3]. Accordingly, it is not surprising that consumers are beginning to actively engage in making decisions about their health, healthcare and spending.

More patients are now engaging with providers in search for better care with their limited/fixed budget on healthcare spending by hopping/shopping providers who provide the best value that money can buy. Such a patient engagement also provides caregivers an opportunity to improve customer acquisition and retention, strengthen brand recognition, and develop competitive advantages in the healthcare market. With patient engagement, relationships with healthcare providers are also changing. Healthcare consumers want access to their healthcare the way they have accessed to other service industries, such as purchasing airline tickets or booking hotels where customers are searching for information that improves economic value for their healthcare spending/investment. Fueled by telehealth especially during the Covid-19 pandemic, healthcare consumers now are actively participating in search for the best buy for their health management. Although it is still in infancy, the move has already created healthcare consumerism. The concept of consumerism in health care is a recent movement and is generally understood to mean that people proactively using trustworthy, relevant information and appropriate technologies to make betterinformed decisions about their health care options in the broadest sense, both within and outside the clinical setting [4]. Three factors underline successes of consumerism: trust-based commitment, comprehensive information display and technologies. Absence of any one of these requirements will hamper successful omnichannel implementation.

Healthcare consumerism has opened up a new territory in healthcare market. Prospective healthcare consumers now behave like any shoppers in the retail markets who want good customer service, price transparency, visible quality indicators, the ability to shop around for services, and more importantly, the ability to engage with their providers in a way that is convenient for “patients” and not just for providers. For many years, healthcare providers act like monopolistic agents in the market where customers have literally no voices in managing their health.

With information technologies readily available to consumers, patients now are looking for “one-stop shop” care entry into the market for not only within a given provider system but throughout entire care delivery system in a seamless process so that they have clear choice where, how and when they seek care. Such seamless “care shopping” is called healthcare omnichannel where patients now be able to surf the care providers who meet their healthcare needs through a single-entry point into the care platform yet connecting all necessary points for holistic care delivery. This means that patients want good customer service, price transparency, the ability to shop around for care, and most importantly, the ability to engage with their providers in a way that is convenient for them (patients). Omnichannel patient engagement means each of these entry points merge together to provide the best “shopping” experiences.

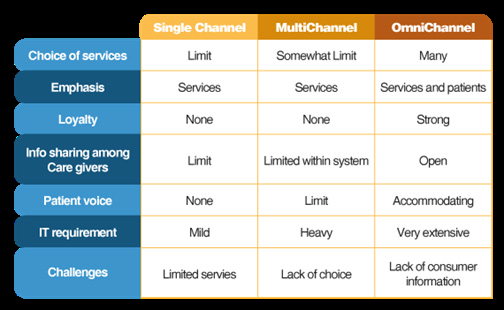

Omnichannel market is an extension from single channel to multichannel delivery system in order to meet the growing consumer demand for seamless shopping experiences. Technologies have played a significant role in channel developments last several decades. In order for us to understand omnichannel healthcare market, it is important to understand single and multichannel healthcare delivery systems in the healthcare market.

The purpose of this Note is to review the essence of omnichannel in healthcare market and provide a framework for a successful healthcare omnichannel implementation. This paper uses explanatory format as a research tool since no prior research has been reported on healthcare omnichannel.

Literature Review in Channel Development in Healthcare Markets

Single channel provider

Single channel provider has a stand-alone healthcare entry mode. Some single channel providers offer comprehensive care (community healthcare providers) and others specialize few areas of their specialties (e.g., cancer center). There is no information exchange between a single channel healthcare provider with other providers in the market. The stand-alone channel, however, provides a wide array of profitable specialty care services and has a high case mix index, enabling it to earn favorable margins per case. In addition, the single channel providers have built an integrated, closely-aligned physician network. The single channel providers benefit from strong community support. They usually provide intimate shopping experience for patients as providers and users have established long standing relationship in the past. As such, patients are reluctant to switch to other care settings because of high emotional separation cost.

However, the single channel providers have a difficult challenge as their limited resources may not be able to adopt the advanced technologies and compete with other multichannel providers in the market. As a result, there have been a steady decline of the numbers of single channel providers in the healthcare market in the United States. On average, the three largest health systems in a given area accounted for more than three-quarters of admissions [5]. Over time, the number of single channel providers has declined as a result of mergers and acquisitions [6], while the number of providers that are part of larger systems has risen. By 2017, two thirds (66%) of all healthcare providers were part of a larger multichannel system, as compared to 53% in 2005 [7].

Multichannel providers

Multichannel delivery system, on the other hand, includes care delivery by multiple healthcare entities within a single system. For example, BJC Healthcare Systems in St. Louis, Missouri has 13 healthcare organizations within its systems. Patients routinely enter into BJC System from any point within the system and information on patients is shared across the system avoiding repeat entry processes, thereby improving patients’ “shopping experiences”. When patients enter into the multichannel system, patients’ information and type of cares (services) received and/or to receive at other hospitals in the system is already available. The main emphasis is on products (services) and not on patients. As such, a long-term relationship with patients is not the top priority in multichannel delivery system.

In some instance, a multichannel system may form alliance with other systems within a market to avoid duplicate and expensive services in the same market. For example, cancer center may form a multichannel agreement with a comprehensive healthcare system like BJC Systems thereby creating a seamless patient experience. By the end of 2016, there were 626 multisystem providers in the U.S (almost 70% of total providers), which accounted for almost 92% discharges [8].

Omnichannel providers

Changes in consumer behavior, especially during the Covid-19 pandemic in 2020, and the advent of new technologies in the consumer markets, have fostered the transition from multichannel consumer shopping experiences to omnichannel marketing. Digital transformation in healthcare arena opened a new frontier of healthcare on-demand. One in three American adults have gone online to assess a medical condition, 72% of internet users mentioned that they looked online for health information within the past year, 47% of internet users search for information about doctors or other health professionals, 38% of Internet users

search for information about hospitals and other medical facilities [9]. Telehealth saw its heyday during the Covid-19 pandemic, when healthcare providers had to close their doors to non-urgent patients to accommodate the Covid-19 patients. During that period, telehealth proved to be an essential way to maintain chronic disease management for high-risk patients. Patients, based on their shopping experiences at retail market through technologies such as apps, online portal, web, etc., demand healthcare providers similar shopping experiences in their healthcare option. They prefer “one-stop” shopping of their care regardless whether they are in single channel or in multichannel systems.

In addition, consumers demand intimate “relationships” with providers, so they feel “good” about their care once received. Only when the customer has gathered as much information from a variety of sources to support their purchase decision, will they decide to buy from a retailer. Omnichannel operations focus on the entire customer experience from registration to discharge and beyond.

The most significant characteristics in omnichannel care is the provider’s ability to generate seamless continuum of care across the multichannel organizations in a system. Multichannel is prerequisite for omnichannel experiences. Customers in omnichannel platform feel as if they were receiving care under a single channel platform. Intimate and personal relationship between patients and care givers at the point of contacts and throughout the entire process is crucial. During this process, providers create unique opportunity to manage their care through patient’s entire lifecycle. Loyal and repeated customers are cornerstone for retailers for sustainable grow in the market. Even more so for healthcare providers as patients become “picky” in selecting healthcare personnel especially, physicians, whom they may form a lifetime relationship.

Omnichannel in retail market

Although omnichannel is a new and untested concept in healthcare, it has been extensively used in retail marketing and in supply chain arena for many years. The essence of omnichannel is a full integration across all channels from both a customer and retailer perspective [10]. The purpose of omnichannel specially in retail industries is to create a consistent customer experience across multiple channels, starting from brand awareness, all the way through fulfilling and delivering customer orders. The omnichannel approach allows shoppers to enjoy a seamless and unified experience whether they’re shopping online on their smartphone, browsing through social media, or visiting a brick-andmortar location. Using a variety of tools, each of which is connected to one another, customers are able to enter shopping experience from multiple platforms without interruptions.

By giving consumers a unified pathway across the patient experience and care continuum, healthcare organizations can meet the rising demands of healthcare consumerism. One study shows that digital channel increased sales by a massive 23%, increase customer royalty (repeat sales) by 23% within six months after an omnichannel shopping experience and were more likely to recommend the brand to family and friends than those who used a single channel, and better data collection [11].

Research also reveals that the best sellers will win the omnichannel revolution by working across the permeable boundaries of information and fulfillment, offering the right combination of experiences for the customers that demand such platforms [12]. Successful strategies for omnichannel, therefore, provide attractive pricing and displayable contents, harness the power of data and analytics [13]. The same study indicates that brand familiarity has a strong influence on omnichannel (in-store, online and mobile). Multiple factors, such as brand familiarity, customization, perceived value and technology readiness as influencing factors of an omnichannel experience, and the use of multiple touchpoints simultaneously to enhance their overall customer’s experience [14]. Integrating this experience across all channels allows for a consistent and seamless customer experience which empowers the customer with more self-control to shop [15]. A similar study finding was also reported by [12].

From supply chain prospective, omnichannel strategy assumes information sharing across the entire channels (touch points) from sourcing to last mile delivery creating risk pooling effect. As a result, demand variability is reduced across locations [16]. Forecasting and planning become much more effective. Information sharing is the most critical factor in supply chain optimization process [17,18].

Omnichannel in patient care

Based on experiences in retail marketing and supply chain operations, it is apparent that omnichannel in healthcare must integrate the following areas: good knowledge on consumers (patients), what drives consumer’s behaviors, guide the patients toward the information they need to make better decisions, engage patients to help prepare them for and enable behavior change, and inspire patients to build loyalty [19]. Patient loyalty is the combination of good clinical quality and a good patient experience. Organizations that can deliver good outcomes plus high patient satisfaction will be well-equipped to build deep patient loyalty. This implies that patients want good customer service, price transparency, the ability to shop around for care across the multichannel platform within a system and across the systems, and most importantly, the ability to engage with the providers in a way that is convenient for patients.

More organizations are recognizing a need for omnichannel patient engagement technologies. By unifying and standardizing this health IT infrastructure within a system, organizations can support the patient across the care journey. But offering omnichannel technology is more than just hosting those tools and apps; it is about unifying a patient experience. Omnichannel patient engagement means each of these entry points merge together. Offering patient engagement technology on an ad hoc basis with fragmented entry points are a good way to discourage patients from actually using them (Figure 1).

Challenge for Healthcare Omnichannel

One of the important success factors in omnichannel deployment in any market is digital knowledge and access to the digital platform across the entire care organizations/providers. A lack of knowledge on digital platform in healthcare will severely hamper omnichannel potential and deployment. Unfortunately, the adoption of telehealth was not equally accessible to different populations. For example, nearly 75% of households either lack or are unaware of telehealth options or both [20]. In addition, much like coronavirus cases, there were stark racial health disparities in pandemic-era telehealth use and adoption. Older black and Hispanic patients used telehealth at significantly lower rates than their white and Asian counterparts [21], and people in inner cities may not use telehealth as much and often as they should, due mainly to inadequate infrastructure of broadband. In the United States, 6% of population still are lacking broadband. Inadequate access to broadband technology for telehealth tends to reduce vulnerable groups from participating in telehealth treatments creating what we call “digital divide”. In essence, digital divide separates those who “have” from those who “do not have’ digital communication capability, thereby further deepening health disparity among population [22]. In healthcare, the digital divide can lead to disparities in patient portal adoption, telehealth care access, or ability to utilize patient-facing management software, like online appointment scheduling, etc.

Digital divide poses even a greater challenge for the older population who consume higher proportion of healthcare spending. For example, among the top five percent of Americans on healthcare spending, the vast majority of these individuals were 65 years or older. Although this population shares only 16% of the total population, they consume 36% of total healthcare spending [23]. Digital divide for older population is not confined to the United States. This issue is a universal challenge so much so that United Nation addressed this specific issue in their 2021 Fourth Review and Appraisal of the Madrid International of Action on Aging specifically asking each country further elaboration of the Asia-Pacific Information Superhighway that will allow countries to develop policies and action plans to achieve digital equity for all ages. Among those policies, it highlights digital literacy and narrow digital skills gaps of older persons through tailored peerto- peer or intergenerational training programs. Expanding digital infrastructure, geographical coverage and digital inclusion of older persons through targeted policies and programs will improve access, enable greater social participation, empower older persons, and enhance their ability to live independently.

Another area that needs to be explored is how much and how extensively healthcare providers are willing to post on their information sites the sensitive information such as price/cost, quality of care (e.g. infection rates, falls, readmission rates to the care providers within a month from discharge, etc.). One of the most important and attractive features for omnichannel users in retail markets is a price comparison between retailers. Through the digital tools, consumers navigate quite easily through many channels for the best “shopping” experiences. Such important piece of information is absent in healthcare market that may hamper “efficient shopping”.

Conclusion and Future Agenda

Current research on omnichannel healthcare is in at infancy. The most important requirement for omnichannel is information sharing and choice across the multichannel journey on telehealth platform. A recent study reveals that healthcare consumers are not very happy with telehealth due mainly to limited services, lack of awareness of cost/price, confusing technology requirements and lack of information on care providers [24]. Information technology in telehealth has been designed primarily for so-called Generation Y who are “tech savvy” in almost every aspect of technology. Yet, most of healthcare spending is on older population who are not as “savvy” as Generation Y in technology. If price/cost are not included in websites and the technology platform is not user friendly, the future of omnichannel in healthcare market is not promising.

A journey from multichannel healthcare platform to omnichannel faces many obstacles and challenges. Cost comparison between multichannel providers is almost impossible. Even if cost comparison is listed in the website, as long as consumers (patients) are loyal to their providers, they are very reluctant to make a switch as emotional cost in separation is very high for many patients, especially older patients. To them, demand for care is highly inelastic to price to the point that they are even reluctant to switching other providers within the same multichannel providers.

However, the roadmap toward omnichannel is not as hard as it seems to be. Almost 70% of total providers are already in multichannel systems with 92% total discharge [8]. Information sharing among and between caregivers (hospitals) within a multichannel system can be used as a platform for omnichannel delivery system. Services and personnel in a multichannel system should be standardized for easy comparison for searching and connecting across the entire system with a single-entry point. Pertinent and important information such as cost/price, quality indicators, roadmap from registrations to discharge, direction to the place, parking space, etc. should be clearly displayed for those digitally less inclined patients. If and when technical connection during the search and navigation is broken, users should be automatically redirected to “help desk” without repeating the entry process all over again.

Once well-established multichannel system is in place, a process of connecting other multichannel systems with similar mission and purpose in the same market or across the different markets could be initiated. Considering the nature of healthcare markets, it will be a long journey with many obstacles to overcome for uncertain rewards. Yet, consumers are demanding this type of healthcare access and experiences. Perhaps, they deserve such services.

References

- Flavelle C (2015) Next health-care fight? Out-of-pocket costs. Bloomberg View.

- (2020) World Health Organization, “World Health Statistics”.

- Anand P, Coe E, Cordina J, Rivera S (2016) Understanding consumer preferences can help capture value in the individual market. Healthcare Systems and Services Practice, McKinsey and Company. pp: 1-13.

- Carman K, Lawrence W, Siegel J (2019) The ‘New’ Health Care Consumerism. Health Affairs Blog.

- Cutler DM, Morton FS (2013) Hospitals, Market Share, and Consolidation. JAMA 310(18): 1964-1970.

- Hall K (2021) Partnerships, mergers, and acquisitions can provide benefits to certain hospitals and communities. American Hospital Association.

- American Hospital Association (2018) Trendwatch Chartbook 2018 | AHA. Chartbook. American Hospital Association, USA.

- Agency for Healthcare Research and Quality (2016) Compendium of U.S. Health Systems, USA.

- Fox S, Duggan M (2013) Health online 2013, Pew Research Center, USA.

- Beck N, Rygl D (2015) Categorization of multiple channel retailing in Multi-, Cross-, and Omni-channel retailing for retailers and retailing. Journal of Retailing and Consumer Services 27(6): 170-178.

- Sopadjieva E, Dholakia UM, Benjamin B (2017) A Study of 46,000 Shoppers Shows That Omnichannel Retailing Works. Harvard Business Review.

- Bell DR, Gallino S, Moreno A (2017) Offline Showrooms in Omni-Channel Retail: Demand and Operational Benefits. Management Science 64(4): 1-43.

- Brynjolfsson E, Hu YJ, Rahman MS (2013) Competing in the age of omnichannel retailing. MIT Sloan Management Review 54(4): 23-29.

- Hickman E, Kharouf H, Sekhon H (2020) An omnichannel approach to retailing: demystifying and identifying the factors influencing an omnichannel experience. The International Review of Retail, Distribution and Consumer Research 30(3): 266-288.

- Zhang M, Ren C, Wang GA, He Z (2018) The Impact of Channel Integration on Consumer Responses in Omni-channel Retailing: The Mediating Effect of Consumer Empowerment. Electronic Commerce Research and Applications 28: 181-193.

- Simchi Levi D, Kaminsky P, Simchi Levi E (2021) Designing and Managing the Supply chain 4th (Edn). McGraw-Hill Publisher, USA.

- Kwon Ik Whan, Suh Tae won (2004) Factors Affecting the Level of Trust and Commitment in Supply Chain Management. Journal of Supply Chain Management 40(2): 4-14.

- Kon Ik Whan, Suh Tae Won (2005) Trust, Commitment and Relationships in Supply Chain Management-Path Analysis. Supply Chain Management, International Journal 9(5): 26-32.

- Cordina J, Kumar R, Olson E (2017) Enabling healthcare consumerism. Healthcare Systems and Services Practice, McKinsey and Company.

- JD Power (2019) US Telehealth Satisfaction Study, USA.

- Weber E, Miller SJ, Astha V, Janevic T, Benn E (2020) Characteristics of telehealth users in NYC for COVID-related care during the coronavirus pandemic. J Am Med Inform Assoc 27(12): 1949-1954.

- Kwon IW, Kim SH (2021) Digital Divide as A Barrier to Comprehensive Digital Health Transformation. American Journal of Biomedical Sciences and Research13 (1): 39-40.

- Sawyer B, Claxton G (2019) How do health expenditures vary across the population? Health system Tracker, Peterson-KFF.

- JD Power (2021) U.S. Telehealth Satisfaction Study, USA.

We use cookies to ensure you get the best experience on our website.

We use cookies to ensure you get the best experience on our website.