Opinion

Creative Commons, CC-BY

Creative Commons, CC-BY

A Fair Game in the Real Estate Market

*Corresponding author: Wu Dongfeng, Department of Bioinformatics and Biostatistics, School of Public Health and Information Sciences, University of Louisville, USA.

Received: February 12, 2025; Published: February 18, 2025

DOI: 10.34297/AJBSR.2025.25.003378

Opinion

A lawsuit involving the National Association of Realtors (NAR) shocked the real estate market in August 2024, and there were some publications on this topic [1-2]. This is a great start to shore up the real estate market. We would like to discuss this issue from the perspective of homeowners. We want to suggest a fee approach that is a fair game for both the seller and the buyer in real estate transactions. Over the years, the NAR ruled that 6% of the selling price of a property will be paid by the seller as a commission fee to pay the services of both the seller’s and the buyer’s agents. As for how the 6% money was split between the two agents, whether it is 50-50 for each, 60-40, or any other arrangement, the two agents can negotiate between themselves. But the 6% is a fixed number for the sellers to pay, and that is not a small number based on the property sale price. In fact, even if it is lowered to a smaller number such as 2%, It is still not fair for the seller and not fair for the buyer either. Both the seller and the buyer are bearing this cost, the only people who gain from this rule are the two agents. When more agents join the NAR due to the easy-to-earn profit, the NAR gains more power, membership, and money from this rule. And this leads to higher housing prices consistently, which are beyond the affordability of most middle classes. The reason is very simple: this rule makes a buyer’s agent face a conflict of interest. If the buyer’s agent truly helps the buyer to negotiate a lower price, that means a smaller commission fee and hence a lower payment for both agents. The buyer’s agent in this case is facing a dilemma and has to fight against his/her own interest. Based on human nature, it is very hard for a buyer’s agent to truly work for the buyer to get a lower price, as this is a direct conflict with his/her payment. We cannot fight against human nature. So, this rule of a fixed commission fee is a hoax, and no matter how low the commission percentage is, it will lead to boosting house prices, and eventually, it is beyond the reach of the middle classes, and both the buyer and the seller will have to bear the cost. And that is why there are some houses in the market today labelled as for-sale-by-owners to avoid this commission fee.

Many people have observed the unfairness of this rule, but how to fix it and make it a fair game for all parties? First, it cannot be fair unless the buyer and the seller will each pay their agents separately. Once we agree on this, we need a fair payment system for the agents, such that a buyer’s agent would truly work for the buyer, and the seller’s agent would truly work for the seller. Let’s start with a buyer’s agent. The buyer and his agent should have their benefit bond together. How much a buyer’s agent gets paid should be directly connected to how much the agent can save money for the buyer, by lowering the sale price. If the listing price is A, and the final sale price is B, which is usually less than A in most housing markets, then s/he helped the buyer save money in the amount of (A-B). So, a reasonable payment for the agent should be a percentage of (A-B). 10% of (A-B) may be a reasonable starting point, and it can be flexible depending on how large (A-B) is: s/he could get more percentage for a larger (A-B). For example, if (A-B) = $50K, then a 10% payment would be $5K, and it is the buyer’s responsibility to pay his/her agent. The percentage is negotiable between the buyer and the agent. On the other hand, in an overheated market, such as in California, if multiple buyers are bidding for the same property, the final sale price B may be higher than A, then the buyer could only pay a flat minimum fee, such as $4000, and this is also negotiable between the buyer and the agent. They should sign a contract before the buying process.

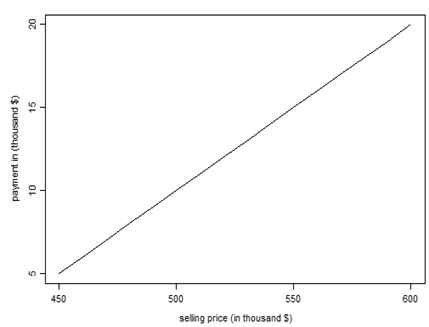

Now let’s look at the transaction for a seller. A seller should only pay for his agent, and their gain should be bonded together. The work performance of the seller’s agent should be measured by how much money the agent can help the seller gain by boosting the sale price. In most markets, the final sale price is lower than the listing price. Since most sellers have a bottom line for the sale price in mind, a payment plan could be designed such that the agent gets the highest payment (H) if the property is sold at the listing price A, and gets the minimum payment (L) if it is sold at the bottom-line price B, and for any sale price in between A and B, the payment is linearly decreasing in the interval (H, L). That is, for any sale price S in the interval (B, A), the reasonable payment (P) would be: P=[(H-L) S+AL-BH]/(A-B) (Figure 1).

Let’s use an example to show this: If the listing price A is $500K, the seller’s bottom-line price B is $450K, the agent will get paid either $10K (H) at the listing price A, or $5K (L) at the bottom-line price B. Any price lower than the bottom price ($450K) will not be accepted. In this scenario, using the thousands of dollars as the unit:

A-B=50, H-L=5, AL=500*5=2500, BH=450*10=4500;

and the linear relationship between the payment (P) and the selling price (S) will be:

P=(5*S+2500-4500)/50=(5*S-2000)/50=S/10-40.

For example, if the final sale price is $480K, then plug in the number S=480 in the above formula, and the agent gets paid P=480/10-40=$8K. A rare scenario in California or some hot market could be that the selling price (B) is higher than the listing price (A). In this case, the same formula listed above could be used. For example, if the final selling price is $550K, then the agents get paid P=550/10-40=$15K. See Figure 1. Of course, this is also negotiable between the seller and the agent. And they should sign a contract before listing the property.

As both agents actively work for the buyer and the seller, the result is a fair housing value and a comparatively stable housing market. Finally, let’s talk about some practical issues. There is no problem for the seller to pay for his/her agent, as the selling of a property brings enough cash to the seller. But will a buyer be willing to pay the agent and buy a property at a fair market value, or a buyer prefer to pay nothing and pay a higher price by taking out more loans? We have gone through the buying process a couple of times, and we think most buyers would prefer to pay their agents so that the agent could truly work for them and buy at a fair price. Some may argue how the buyer pays his/her agent, as mortgage companies usually don’t allow this payment to be wrapped in the loan. Well, the buyers should have saved enough cash to pay for their agents if they want to buy a property at a fair price. And this brings more power to the bargaining process that will benefit them. In summary, removing the 6% rule is a great step toward a fair price in the real estate market, and when buyers and sellers each pay for their agents, the housing price will gradually go in the direction of a healthy and stable market and affordable for most middle classes.

Acknowledgement

None.

Conflict of Interest

None.

References

- https://www.bankrate.com/real-estate/real-estate-commissions-lawsuit-impact/.

- https://finance.yahoo.com/news/end-6-real-estate-commissions-102200726.html.

We use cookies to ensure you get the best experience on our website.

We use cookies to ensure you get the best experience on our website.